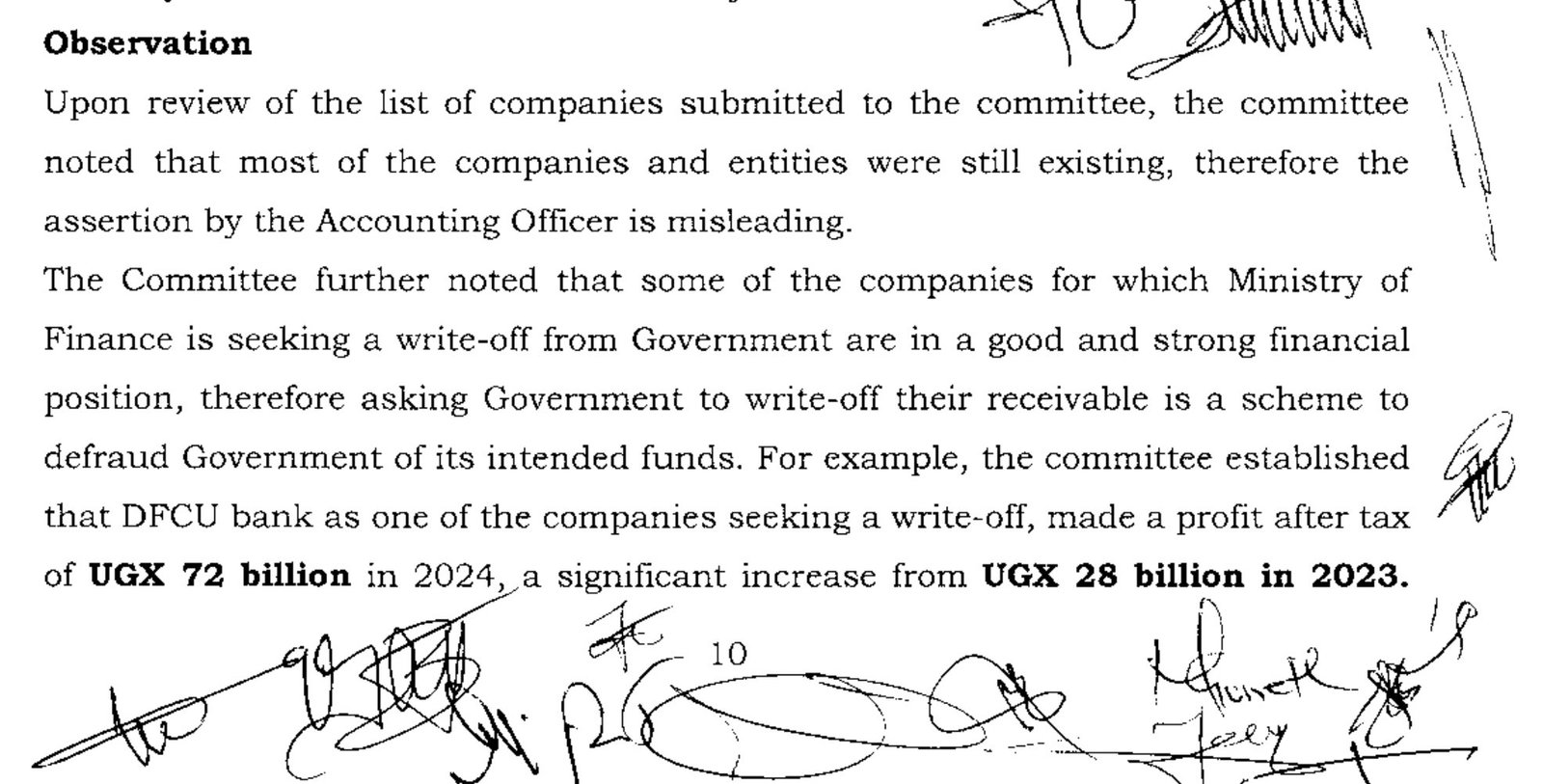

KAMPALA – A Parliamentary Committee has leveled serious allegations against the Ministry of Finance and DFCU Bank, accusing them of orchestrating a scheme to defraud the government by seeking to write off substantial debts owed by profitable companies.

The allegations stem from the ministry’s submission of a list of companies and entities from which it is seeking a write-off of receivables, arguing they are defunct or unable to pay. However, the committee’s review found these assertions to be “misleading.”

In a strongly-worded observation, the committee stated that a majority of the companies on the list are still operational. Most strikingly, it highlighted that several are in a “good and strong financial position,” making the request for a debt waiver tantamount to a fraudulent plot.

DFCU Bank was cited as a prime example. Contrary to being a loss-making entity deserving of a bailout, the committee revealed that the bank recorded a massive 157% increase in net profit for 2024. Its profits soared from UGX 28 billion in 2023 to a staggering UGX 72 billion in 2024.

This revelation has sparked outrage, with critics questioning why a highly profitable institution would need, or accept, a government write-off.

The issue was brought to public attention by a social media user who tagged the involved parties, stating, “We can understand the thieving public officials but why would @dfcugroup attempt to defraud us?”

The committee’s findings suggest a significant misalignment within the Ministry of Finance, Planning, and Economic Development (@mofpedU). The report implies that either due diligence was severely lacking or there was a deliberate attempt to misuse public funds.

This development is expected to trigger a deeper parliamentary investigation and calls for accountability from both the ministry officials involved and the management of DFCU Bank. The government has yet to issue an official response to these allegations.