Bank of Uganda Deputy Governor Outlines Bold Reforms to Attract Investment at UK-Africa Summit

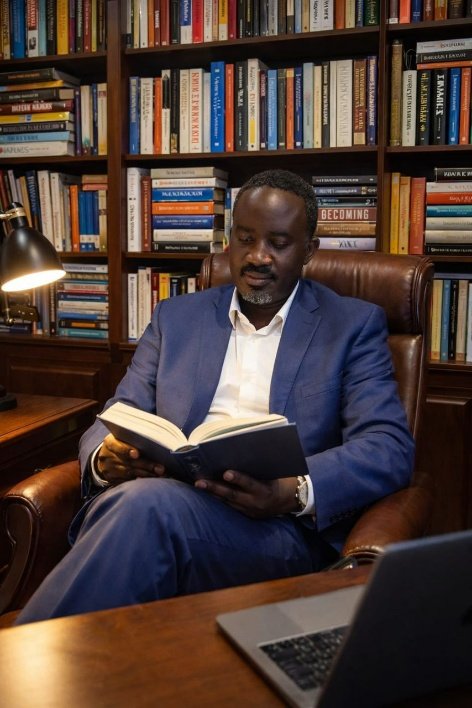

LONDON – The Deputy Governor of the Bank of Uganda, Professor Michael Nuwagaba, has presented a comprehensive roadmap for financial modernization and foreign investment, highlighting significant regulatory reforms and strategic sector opportunities at the recent UK-Africa Summit.

Speaking at the #UKAfricaSummit, Prof. Nuwagaba detailed the central bank’s strategy to manage macroeconomic risks and create new avenues for private capital, positioning Uganda as a prime investment destination in East Africa.

Strategic Sectors and Incentives

The Deputy Governor pinpointed several high-growth sectors ripe for investment, including oil and gas, agro-industry, infrastructure, and climate-aligned initiatives. He assured potential investors that these opportunities are backed by strong policy stability and ongoing institutional reforms.

A key part of the strategy involves creating a more favourable tax environment. Prof. Nuwagaba stressed the importance of reducing “harmful taxes and uncertainties,” simplifying the tax payment process, and offering targeted tax incentives specifically for investors in the country’s key priority sectors.

Lowering Costs and Promoting Sustainability

To make businesses more competitive, Prof. Nuwagaba emphasised the critical need for reliable economic infrastructure to lower operational costs. Furthermore, he directly linked attracting capital to adopting global sustainability norms.

He advocated for the incorporation of Environmental, Social, and Governance (ESG) standards and the use of green investment incentives. This approach, he noted, is designed to attract responsible investors, particularly in agriculture, manufacturing, and renewable energy.

Sweeping Regulatory Reforms

A significant portion of the address focused on cutting bureaucracy to improve the ease of doing business. The Deputy Governor called for a streamlining of investment procedures, specifically to minimise delays in licensing and permit issuance.

He cited the establishment of an efficient one-stop centre for investors, which should be facilitated by the Uganda Investment Authority (@ugandainvest), as a crucial step in this process.

In a move aimed at liberalising the financial sector, Prof. Nuwagaba emphasised the need to liberalise capital and financial accounts to allow the free movement of private investment capital. He also advocated for permitting foreign ownership of enterprises in strategic sectors.

Finally, he championed the principles of transparency and fair competition, stating they are essential to combat monopolistic practices and unethical business behaviour, thereby creating a level playing field for all investors.

The address signals a strong commitment from Uganda’s central bank to work hand-in-hand with the private sector to drive economic growth through modernisation, strategic investment, and robust regulatory reform.