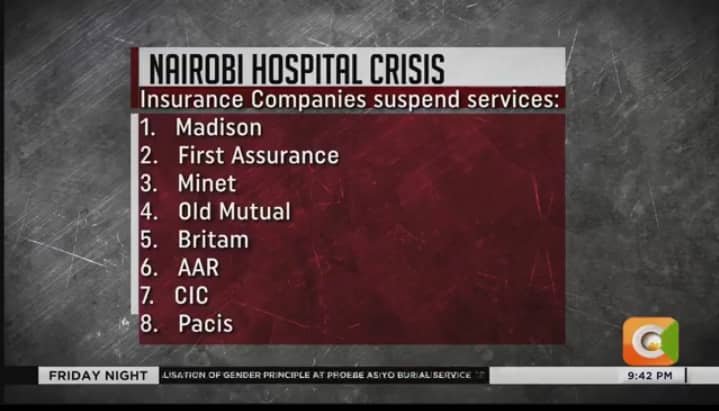

Nairobi, Kenya – Eight insurance companies have halted services at Nairobi Hospital, citing a sharp increase in treatment costs at the facility. The move leaves thousands of policyholders scrambling for alternative healthcare options as the dispute between insurers and the hospital escalates.

The insurers argue that the hospital’s recent price hikes are unsustainable, making it difficult to provide affordable coverage to their clients. Reports indicate that the cost of various medical procedures at Nairobi Hospital has surged by as much as 30% in recent months, prompting the insurers to take action.

A representative from one of the affected insurance firms stated, “We have engaged Nairobi Hospital in negotiations to address these cost concerns, but no agreement has been reached. As a result, we have no choice but to suspend services to protect our clients from excessive charges.”

Nairobi Hospital, one of Kenya’s leading private healthcare providers, has yet to issue an official statement on the matter. However, sources within the facility suggest that the rising operational costs, including medical supplies and staffing, have necessitated the price adjustments.

The suspension has sparked concern among patients, particularly those with chronic conditions who rely on the hospital for specialized care. Some policyholders have expressed frustration, accusing both the insurers and the hospital of failing to prioritize patient welfare.

Industry analysts warn that the standoff could have far-reaching implications for Kenya’s healthcare sector, potentially leading to higher premiums or reduced coverage options if other hospitals follow suit.

As the situation develops, stakeholders are calling for urgent mediation to resolve the dispute and restore normal services for affected patients.