JUBA – In a significant step towards modernizing its financial sector, the Bank of South Sudan (BoSS) officially launched the South Sudan Inter-Bank Payment and Settlement System (SSIPS) on Friday, October 10, 2025.

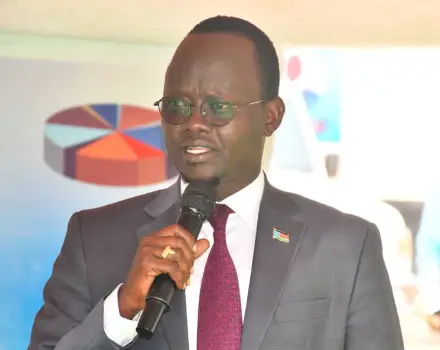

The new system, described by central bank governor Dr. Addis Ababa Othow as a “fundamental engine of a modern economy,” is designed to improve cash transactions between banks and expand financial access across the world’s youngest nation.

The SSIPS is an automated platform that integrates two key components:

· Real Time Gross Settlement (RTGS): For urgent, high-value payments.

· Automated Clearing House (ACH): For processing bulk, low-value transactions such as salary and utility payments.

“This system will enable real-time payment and instant funds between individuals and businesses 24 hours a day and seven days a week,” Dr. Othow stated during the launch ceremony in Juba. “What it means is that you can make the payment instantly within the financial system and across the banks.”

The governor emphasized that the SSIPS will enhance interoperability, allowing for smooth transactions between banks, mobile money platforms, and financial technology (fintech) companies. He also highlighted its role in promoting financial inclusion by bringing the unbanked population into the formal financial system.

Furthermore, Dr. Othow expects the system to lower the cost of doing business in South Sudan. “As of now, because of a lack of so much infrastructure, many of our investors are discouraged from coming and doing business in South Sudan. With this system, we lower the cost of doing business,” he explained.

Dr. Martin Elia Lomuro, the Minister of Cabinet Affairs, pointed to the system’s potential to improve oversight of the banking sector and control the movement of money. He stated that international organizations and NGOs operating in the country should be compelled to use local banks.

“You can’t claim money outside to come and help South Sudan, and you keep the money in Kenya, or Uganda, or somewhere else,” Minister Lomuro said. He also called on economic security institutions to utilize the system to monitor the flow of funds and combat the illegal movement of money out of the country.

The launch of the SSIPS marks a key milestone in the Bank of South Sudan’s broader reform agenda, aiming to enhance the efficiency, transparency, and security of the national financial landscape.