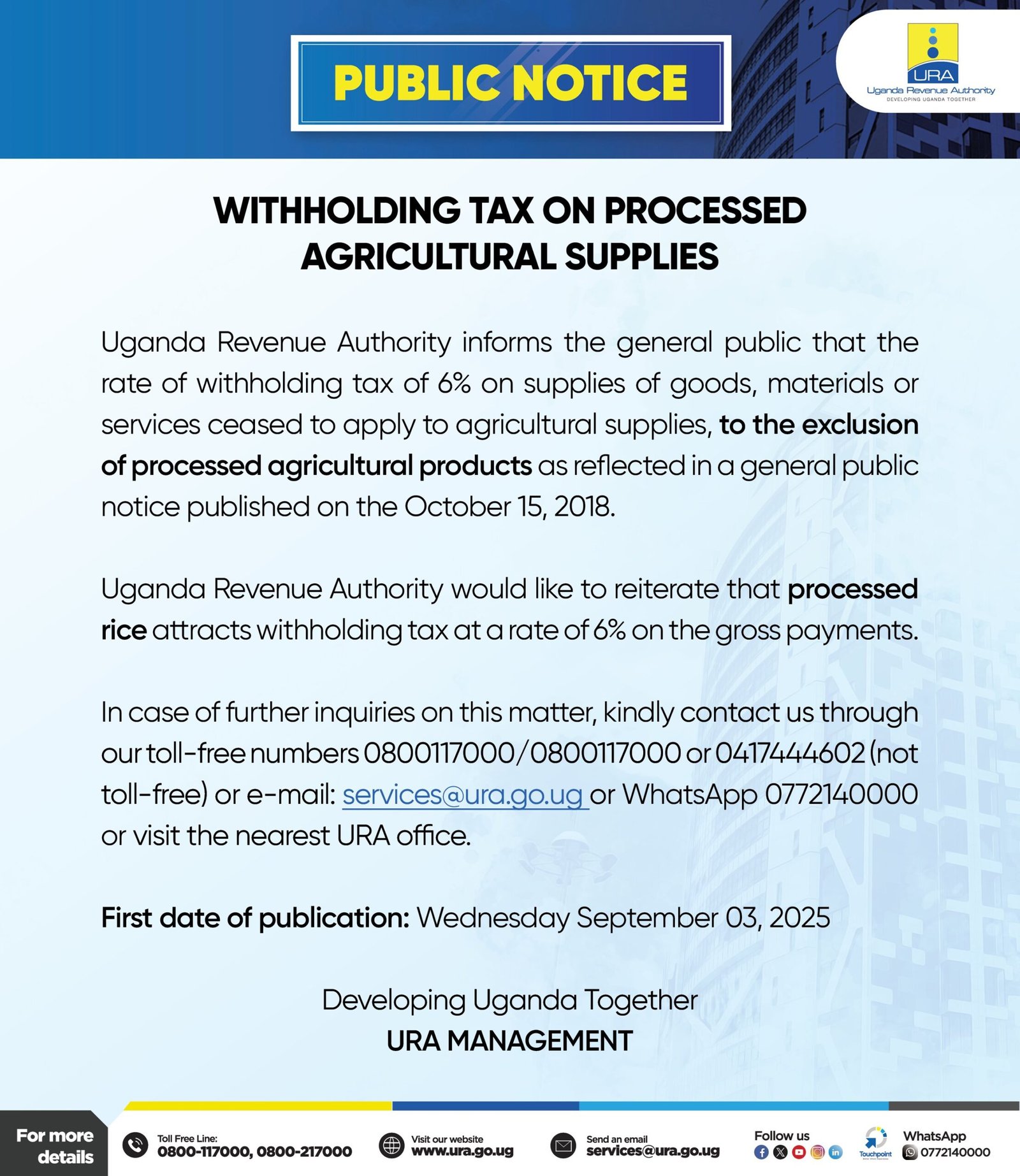

KAMPALA – The Uganda Revenue Authority (URA) has issued a public notice to clarify and reiterate its stance on the application of withholding tax for processed agricultural products, specifically naming processed rice as a taxable supply.

This clarification comes to reaffirm a long-standing policy that distinguishes between raw agricultural supplies and processed goods. According to the notice, a general tax exemption for agricultural supplies, which was communicated in a public notice on October 15, 2018, does not extend to processed agricultural products.

The authority explicitly states that while the 6% withholding tax on the gross payment for supplies of goods, materials, or services was removed for basic agricultural supplies, this exclusion “ceases to apply” for anything classified as processed.

“Uganda Revenue Authority would like to reiterate that processed rice attracts withholding tax at a rate of 6% on the gross payments,” the notice emphasizes. This means all transactions involving processed rice are subject to the standard withholding tax deduction at the point of payment.

The notice, which was first published on Wednesday, September 3, 2025, serves as a reminder to businesses, suppliers, and distributors in the agricultural sector to ensure full compliance to avoid any penalties.

For further inquiries or clarification on this matter, the URA has encouraged the public to contact them through their toll-free numbers 0800117000, the line 0417444602 (not toll-free), via email at services@ura.go.ug, or on WhatsApp at 0772140000. Individuals can also visit the nearest URA office for direct assistance.

This move is part of the revenue body’s ongoing efforts to streamline tax collection and ensure clarity on tax obligations, under its broader mission of “Developing Uganda Together.”

Source: Uganda Revenue Authority Public Notice, September 3, 2025.