KAMPALA – In a significant move aimed at easing the burden on businesses, the Uganda Revenue Authority (URA) has announced the return of a major tax amnesty program, offering a 100% waiver on accumulated interest and penalties for taxpayers.

The announcement, made in a public notice published on Thursday, September 11, 2025, comes as a direct response to continued appeals from the business community. The message from URA was clear: “You asked, government heard your petitions and has responded… The TAX WAIVER IS BACCCK!!!!”

How the Amnesty Works

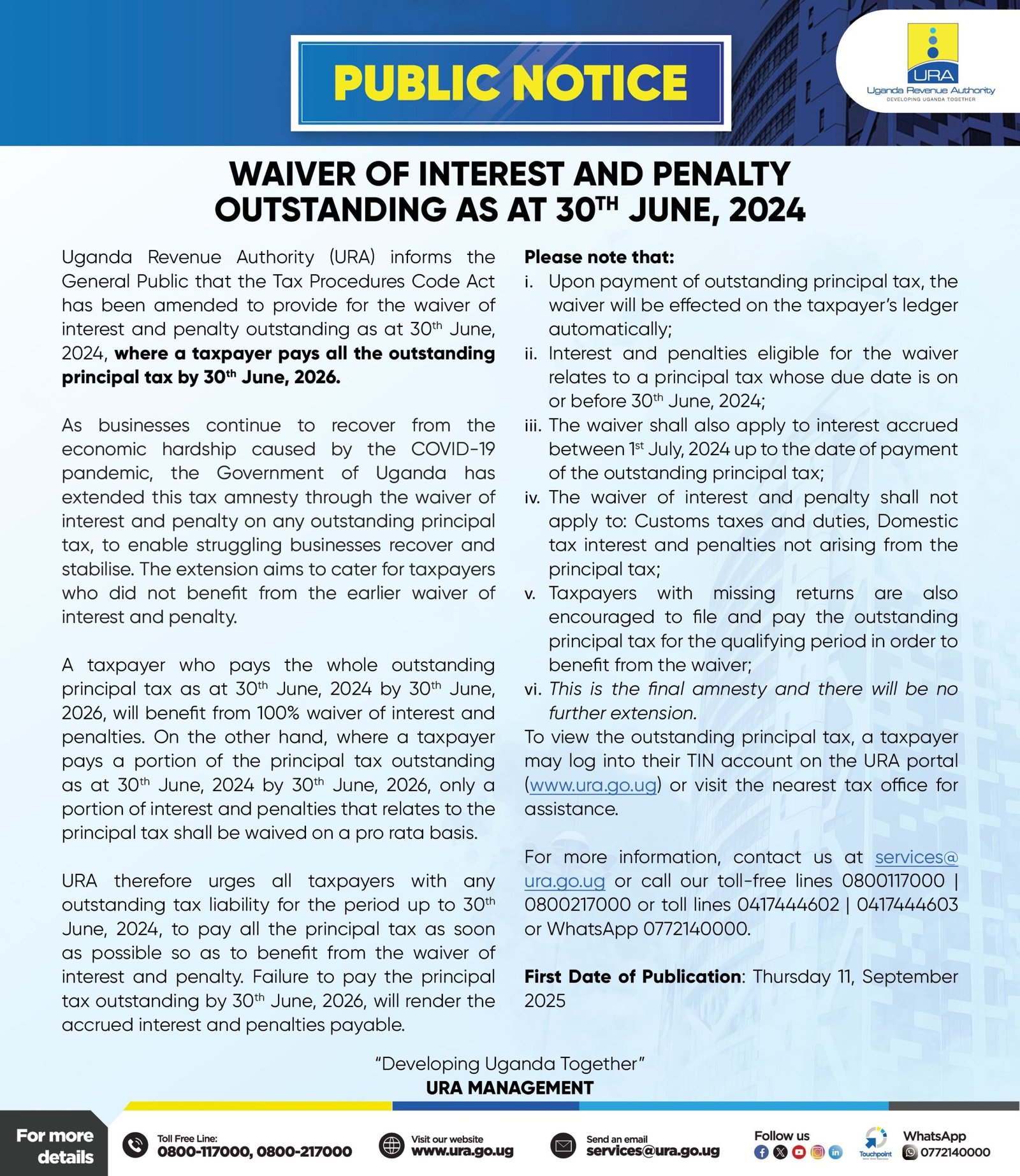

The amnesty is made possible through an amendment to the Tax Procedures Code Act. It provides for a full waiver of all interest and penalties that had accrued on unpaid taxes as of June 30, 2024.

To qualify for this waiver, a taxpayer must pay the full outstanding principal tax (the original tax amount owed) by the deadline of June 30, 2026.

“This extension aims to cater for taxpayers who did not benefit from the earlier waiver of interest and penalty,” the URA notice stated, acknowledging the ongoing economic recovery from the COVID-19 pandemic.

The authority encourages taxpayers to act swiftly. “Failure to pay the principal tax outstanding by 30th June, 2026, will render the accrued interest and penalties payable,” the notice warns.

Key Details for Taxpayers

The URA outlined several important conditions of the amnesty program:

· Automatic Process: The waiver will be applied automatically to a taxpayer’s ledger once the outstanding principal tax is paid.

· Pro-Rata Benefit: Taxpayers who can only pay a portion of the principal tax will receive a proportional (pro-rata) waiver of the related interest and penalties.

· Covered Period: The waiver applies to interest that continued to accrue between July 1, 2024, right up until the date the principal tax is paid.

· Exclusions: The amnesty does not apply to Customs taxes and duties, or to any interest and penalties not directly linked to an outstanding principal tax.

· Final Opportunity: URA has explicitly stated that “this is the final amnesty and there will be no further extension.”

Taxpayers with unfiled returns are also urged to regularize their status by filing and paying the principal tax for the relevant periods to benefit from the waiver.

How to Check Your Tax Status

Taxpayers can view their outstanding principal tax by logging into their TIN account on the URA portal at www.ura.go.ug. Alternatively, they can visit the nearest URA tax office for assistance.

For more information, the public can contact URA via email at services@ura.go.ug, call the toll-free lines 0800117000 or 0800217000, or use the WhatsApp line 0772140000.

This sweeping amnesty represents the government’s latest effort to support business stability and foster voluntary tax compliance by providing much-needed relief from debilitating penalty charges.

Source: Uganda Revenue Authority Public Notice First Published:Thursday, September 11, 2025