LAGOS, Nigeria (September 2025) – A wave of transaction failures, delays, and unresolved debits is sweeping across Nigeria’s financial sector, causing significant frustration for bank customers. The disruptions are linked to mandatory system upgrades directed by the Central Bank of Nigeria (CBN), which include a critical migration to the global ISO 20022 financial messaging standard by October 31, 2025.

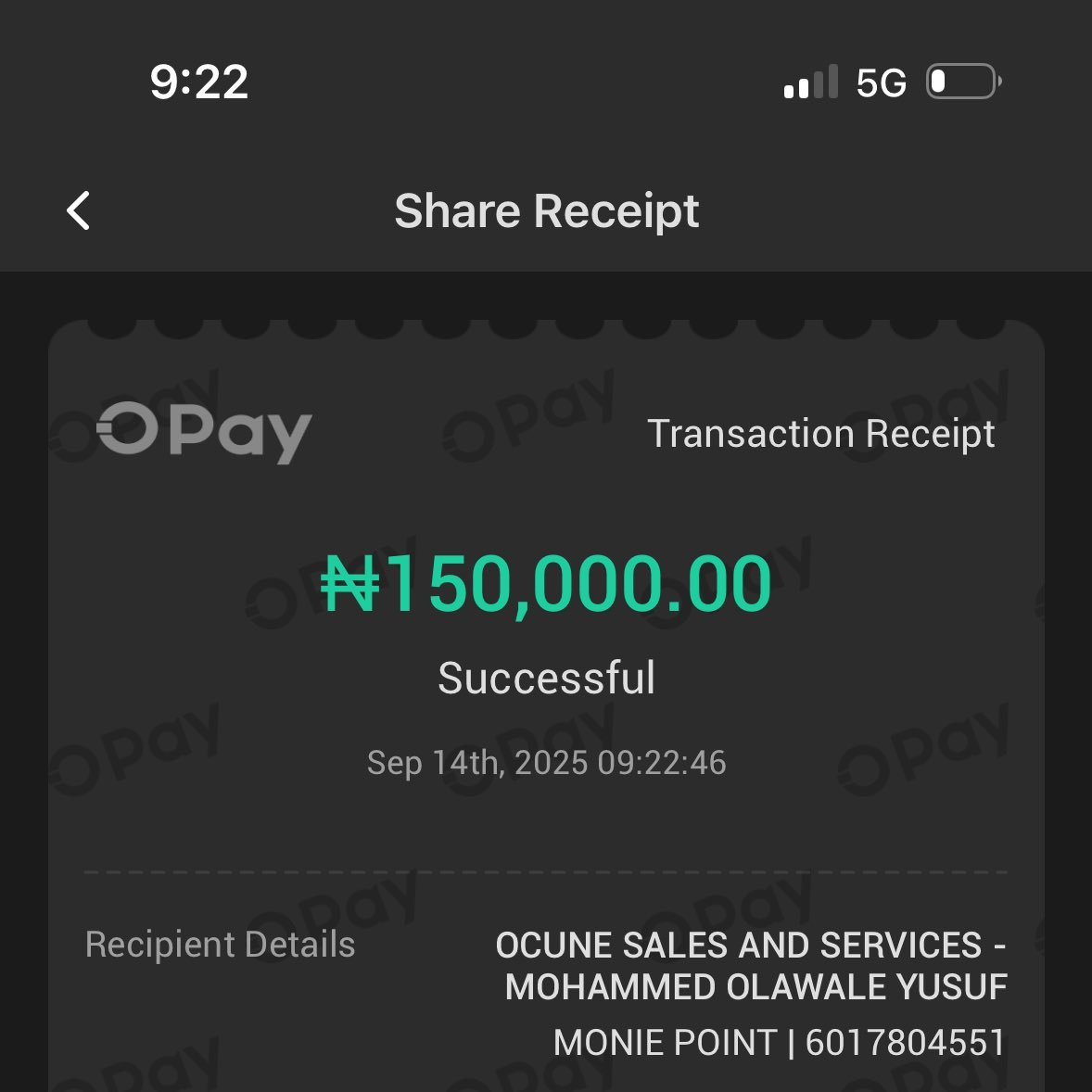

Major commercial banks, including FirstBank and Zenith Bank, as well as leading fintech operators like OPay and Moniepoint, have all been affected. The institutions have taken to social media platform X to acknowledge the technical difficulties. Facing a surge in customer complaints, many have urged users to contact them via direct messages to resolve individual cases, a process that has been overwhelmed by the scale of the problem.

The ongoing issues highlight a broader trend of consumer challenges within the sector. The Federal Competition and Consumer Protection Commission (FCCPC) reported receiving over 9,000 complaints against banking and fintech companies between March and August 2025. Through its interventions, the commission has successfully recovered more than N10 billion for affected customers during that period.

While the current disruptions are causing short-term chaos and eroding customer confidence, financial experts suggest the pain may be necessary for long-term gain. The transition to the ISO 20022 standard is expected to significantly enhance the efficiency, security, and interoperability of payment systems in Nigeria, bringing them in line with global benchmarks.

The situation remains fluid as banks and fintech companies work to stabilize their systems ahead of the CBN’s deadline.

This story is based on developing reports and public communications from the involved institutions.