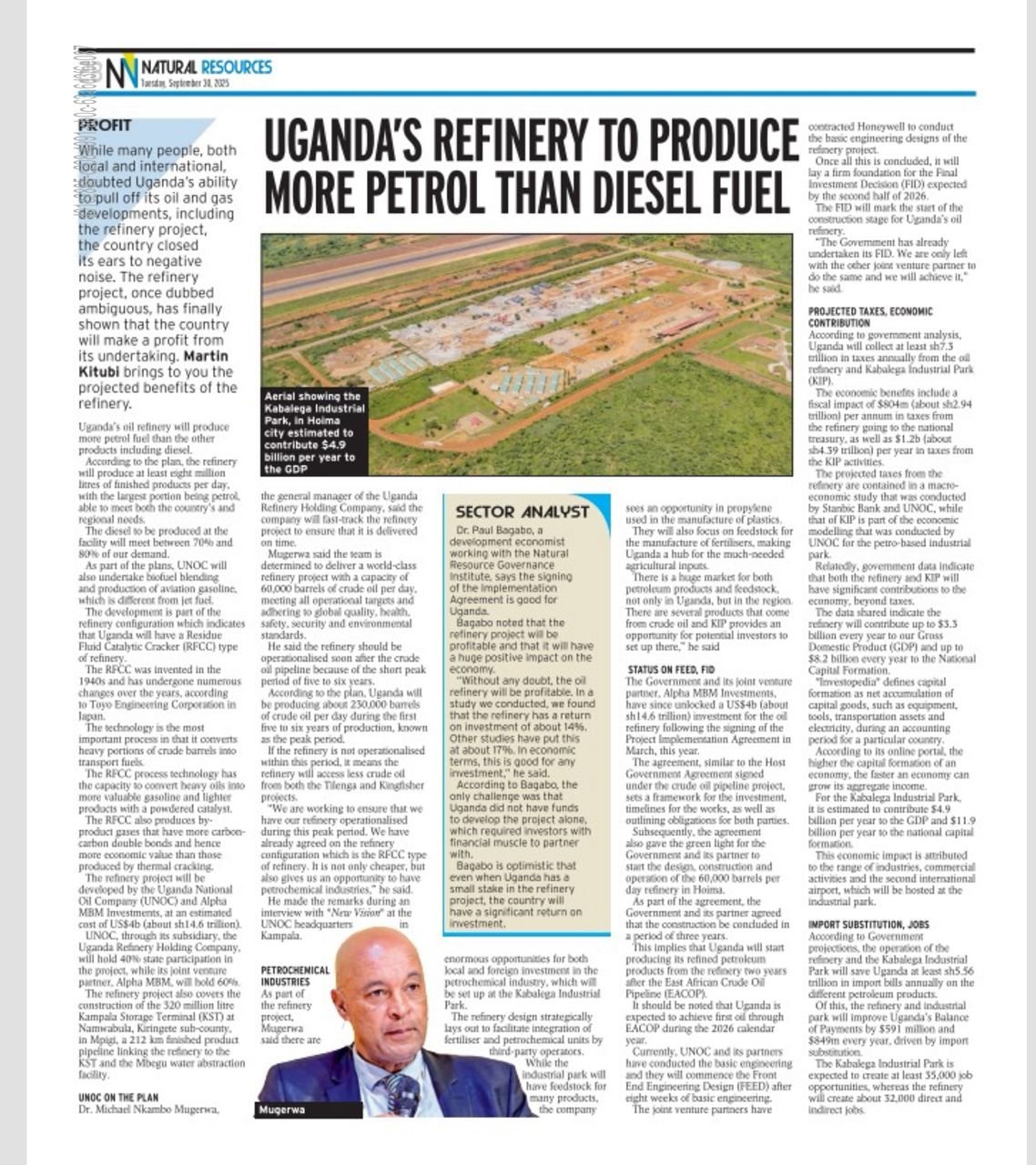

HOIMA, UGANDA – Strategically located in the emerging Kabalega Industrial Park in Hoima, Uganda’s long-awaited $4.5 billion oil refinery is poised to be a monumental economic driver, silencing early doubters and positioning the nation as a regional energy hub. With a planned capacity of 60,000 barrels per day, the project is projected to contribute over $3.3 billion to the national GDP annually and create approximately 32,000 jobs.

The project, a joint venture between the Uganda National Oil Company (UNOC) and Alpha MBM Investments, has solidified its plans following the signing of the Project Implementation Agreement. The refinery will be developed on a fast-tracked three-year construction timeline, aiming to become operational soon after the East African Crude Oil Pipeline (EACOP) begins transportation.

Meeting Domestic and Regional Demand

A key feature of the refinery’s configuration is its product output. It is designed to produce more petrol than other products, including diesel, aligning with market demands. The facility will churn out at least eight million litres of finished products daily, with diesel production expected to meet 70-80% of Uganda’s domestic demand.

According to Dr. Michael Mugerwa, the General Manager of the Uganda Refinery Holding Company, the company is determined to deliver a world-class project.

“We are working to ensure that we have our refinery operationalised during the peak production period,” Dr. Mugerwa stated in an interview. “We have already agreed on the refinery’s configuration which is the RFCC type. It is not only cheaper but also gives us an opportunity to have petrochemical resources.”

Unlocking a Petrochemical Future

The refinery’s strategic design goes beyond conventional fuel production. It lays the groundwork for the integration of fertilizer and petrochemical units by third-party investors at the Kabalega Industrial Park.

Dr. Mugerwa highlighted the enormous opportunities for local and foreign investment this presents. The park will provide feedstock for the manufacture of plastics and, critically, fertilizers, positioning Uganda as a hub for much-needed agricultural inputs in the region.

“There is a huge market for both petroleum products and feedstock, not only in Uganda but in the region,” he added.

Strong Economic Prospects

Development economists have expressed optimism about the project’s viability. Dr. Paul Bagabo, of the Natural Resource Governance Institute, noted that the refinery is projected to be profitable for decades.

“Studies have found that the refinery has a return on investment of about 14%. In economic terms, this is good for any investment,” Dr. Bagabo said.

The refinery will also produce 658 metric tonnes of Liquefied Petroleum Gas (LPG) daily, a move expected to reduce the country’s heavy reliance on charcoal and firewood and promote cleaner household energy.

Once operational, the refinery will not only secure Uganda’s energy independence but also supply the broader regional market, including Kenya, Tanzania, Rwanda, Burundi, South Sudan, and the Eastern Democratic Republic of Congo, truly making it a transformative undertaking for East Africa.