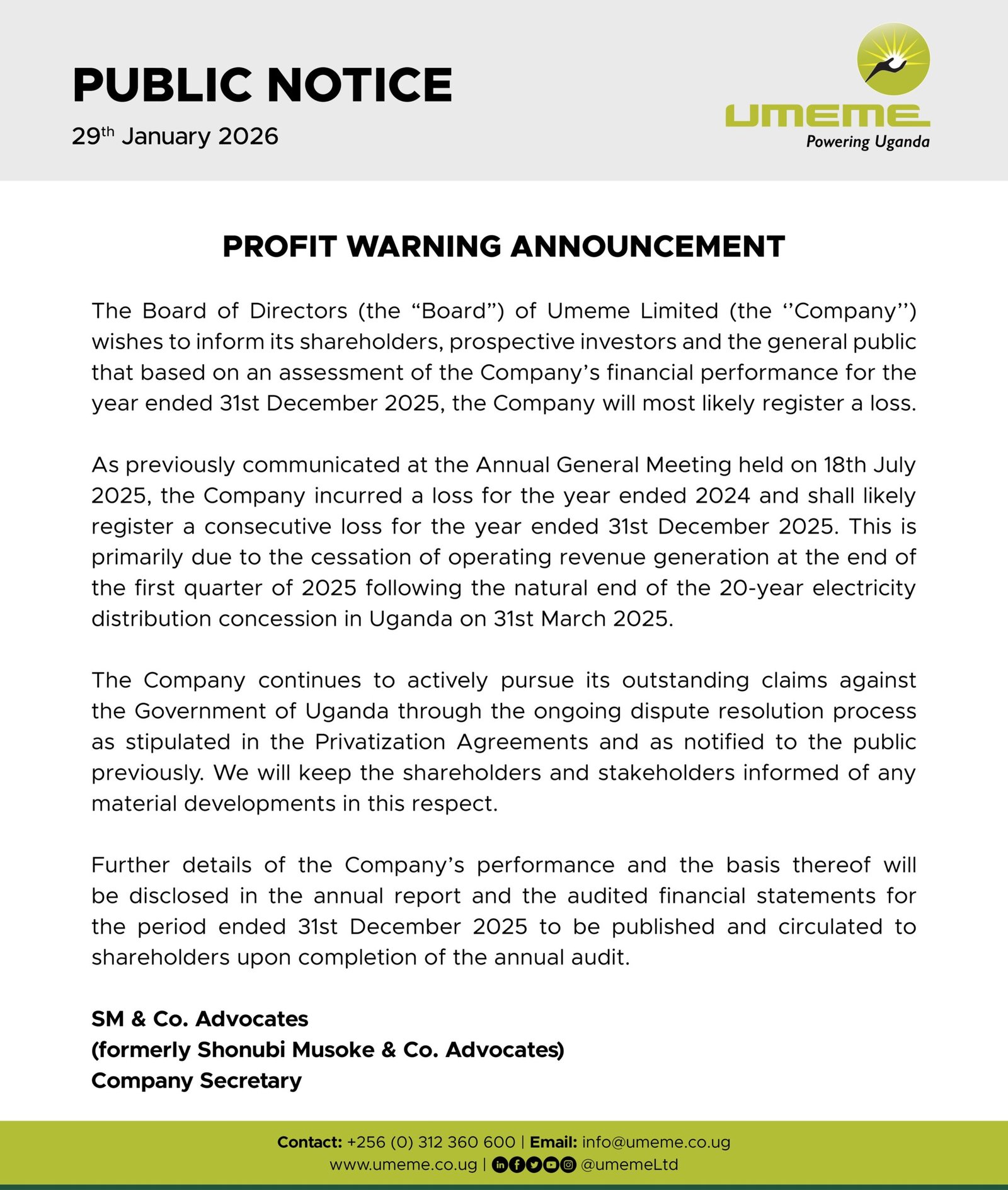

Headline: Umeme Limited Issues Profit Warning, Anticipates Second Consecutive Annual Loss

Subheading: Concession End Halts Revenue, Dispute with Government Continues

KAMPALA — Umeme Limited has informed its shareholders and the public that it expects to report a loss for the financial year ending December 31, 2025. This marks the second consecutive year of anticipated losses for the listed electricity distributor.

In a profit warning announcement released by the Company Secretary, SM & Co. Advocates, the Board of Directors attributed the expected loss primarily to the natural expiration of its 20-year electricity distribution concession in Uganda on March 31, 2025. The company ceased generating operating revenue at the end of the first quarter of 2025 following the concession’s conclusion.

The warning follows a loss reported for the year ended December 31, 2024, as previously communicated during the Annual General Meeting in July 2025.

A critical ongoing factor for the company is its unresolved financial dispute with the Government of Uganda. The announcement stated that Umeme “continues to actively pursue its outstanding claims” through the dispute resolution process outlined in the original Privatization Agreements. The company pledged to keep shareholders and stakeholders updated on any significant developments regarding these claims.

Umeme Limited, a major player in Uganda’s energy sector, was formed following the privatization of the Uganda Electricity Board. Its concession period, which began in 2005, involved managing, operating, maintaining, and upgrading the electricity distribution network.

The board advised that comprehensive details of the company’s financial performance and the basis for the results will be provided in the annual report and audited financial statements for 2025. These documents will be published and circulated to shareholders upon completion of the annual audit.

The profit warning is a formal requirement for listed companies to ensure timely disclosure of material information that may affect investment decisions. Investors and market analysts are likely to monitor closely the outcome of the company’s claims against the government and its strategic direction post-concession.