Government Invests UGX 723.4 Billion for a 9.4% Stake in UGX 2 Billion Company, Raising Alarms

A parliamentary committee has raised serious concerns over a massive government investment in a local company, Dei-Biopharma Ltd, calling the financial logic behind the move into question.

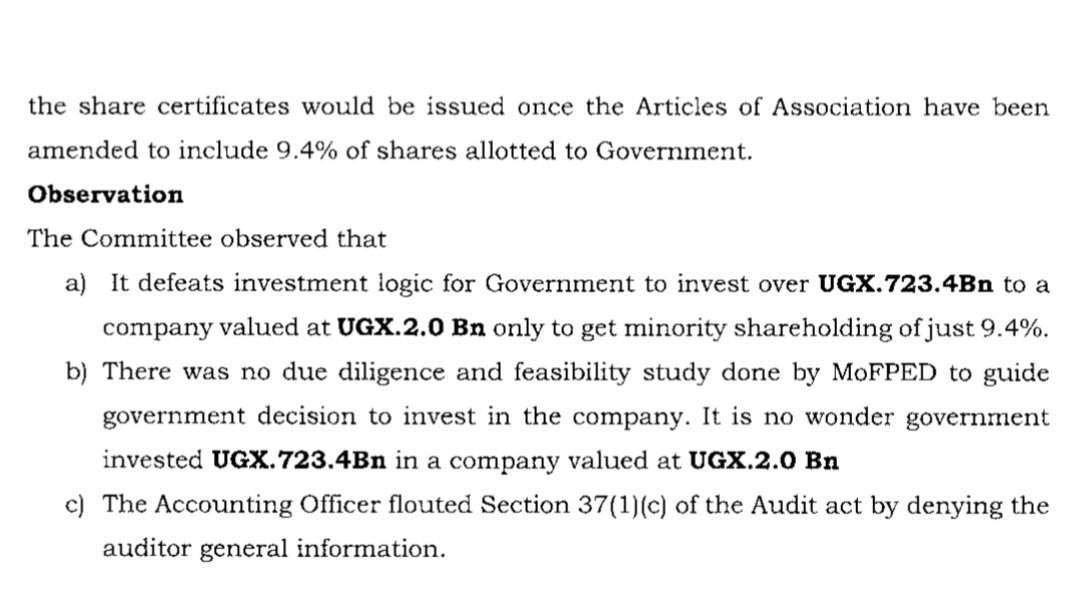

According to a damning committee observation, the government, through the Ministry of Finance, Planning and Economic Development (MoFPED), has invested a colossal sum of UGX 723,400,000,000 (Ugandan Shillings 723.4 billion) into the company. This investment stands in stark contrast to the company’s own valuation, which was reported to be a mere UGX 2,057,466,404 (UGX 2.05 billion).

Despite injecting funds that are over 350 times the company’s stated value, the government is slated to receive a minority shareholding of just 9.4%. The share certificates are to be issued once the company’s Articles of Association are amended to reflect this allocation.

The committee highlighted several critical failures in the process:

a) Illogical Investment: The report firmly states that it “defeats investment logic” for the government to pour such a vast amount of capital into a minimally valued company only to emerge with a minority stake, granting it little controlling influence.

b) Lack of Due Diligence: The committee observed that MoFPED conducted no prior due diligence or feasibility study to guide the decision to invest public funds. The report suggests this oversight is the direct reason behind the baffling discrepancy between the investment size and the equity received, noting, “It is no wonder government invested UGX 723.4Bn in a company valued at UGX 2.0Bn.”

c) Denial of Information: Further compounding the issue, the Accounting Officer at the ministry was accused of flouting the Audit Act by denying the Auditor General access to crucial information regarding the investment, as required by Section 37(1)(c) of the law.

This situation presents a significant risk of the gross misallocation of public funds and has sparked demands for a thorough investigation into the deal and accountability for the officials involved. The colossal investment for a minimal return has left lawmakers and observers questioning the rationale and transparency of the entire transaction.